Network Tokens: The Must-Have Layer of Security in Modern Payments

Make your transactions both safer and smarter with Network Tokens.

Network tokens are transforming how businesses handle online payments. They protect sensitive card data, reduce fraud, and improve authorisation rates, all without adding friction to the checkout process. As more companies move towards tokenised transactions, understanding how they work is crucial for payment success.

What Are Network Tokens?

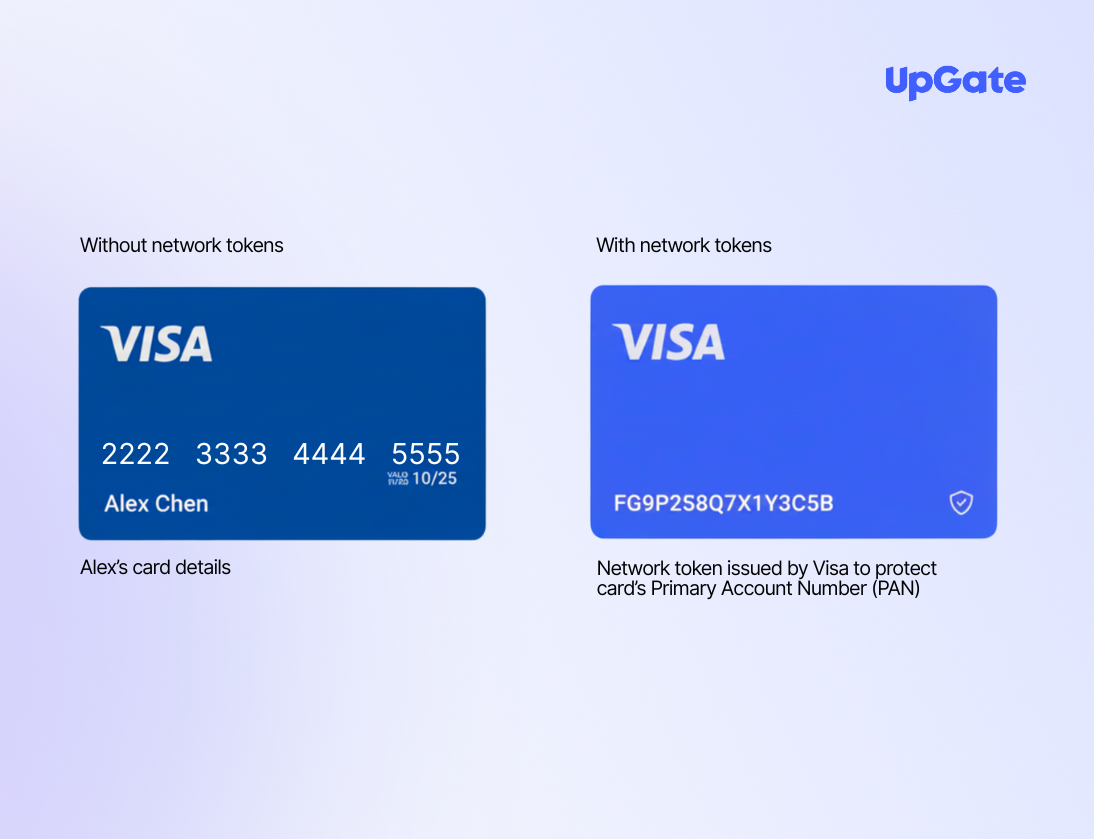

A network token is a secure digital replacement for a card’s Primary Account Number (PAN). It’s issued by card networks such as Visa or Mastercard and used to process payments without exposing the real card number.

When customers save their card details for future use or subscriptions, merchants can store a token instead of the actual PAN. This token is unique, merchant-specific, and automatically updated when the card expires or is replaced, ensuring uninterrupted payments.

In short, network tokens make digital transactions both safer and smarter.

Key Data and Market Insights

Recent studies highlight the growing impact of network tokenisation:

30% of global Visa and Mastercard transactions are now processed with network tokens instead of raw card numbers.

Visa reports that network tokenisation can reduce fraud by 28% on average while maintaining a seamless customer experience.

Card-not-present (CNP) transactions using tokens have a 4.6% higher authorisation rate than those using PANs.

Juniper Research forecasts that global network-tokenised transactions will double by 2029, from 283 billion in 2025 to 574 billion.

These numbers confirm that network tokenisation is no longer optional, it’s a payment strategy that drives higher security and conversion rates.

How Network Tokens Are Provisioned and Managed

Network tokenisation involves several key steps:

Card registration – A customer provides their card details for storage or recurring payments.

Token request – The merchant’s payment service provider (PSP) or gateway requests a network token from the card network.

Token issuance – The card network issues a unique token linked to that customer and merchant.

Automatic updates – If the card expires or is replaced, the network automatically updates the token.

This process reduces PCI DSS compliance scope and eliminates the need for merchants to handle sensitive data directly, enhancing both security and efficiency.

Simplify Network Tokenisation with Payment Orchestration

Implementing and managing network tokens across multiple PSPs and acquirers can be complex. Payment orchestration offers a smarter solution.

A payment orchestration platform like UpGate streamlines network token management by:

Centralising tokenisation across multiple payment providers.

Automating token provisioning and lifecycle management.

Optimising transaction routing for higher authorisation rates.

Reducing compliance risks by isolating sensitive data.

With UpGate, businesses can leverage network tokens across all payment partners, without integration headaches or operational complexity.

Power Smarter Payments with UpGate

Network tokens are reshaping digital payments, providing enhanced security, lower fraud risk, and improved authorisation rates.

UpGate helps businesses adopt network tokenisation through advanced payment orchestration, ensuring every transaction is optimised, secure, and future-ready.

Book a demo today to discover how UpGate can simplify network tokenisation and help you scale globally with confidence.

Book a demo today to discover how UpGate can simplify network tokenisation and help you scale globally with confidence.